Industry insiders are expressing concerns over the impending change in the U.S. trade settlement period from T+2 to T+1, scheduled for May 27. They warn that this shift could negatively impact asset managers in the Asia-Pacific region due to potential disruptions in the flow of assets, timing issues, and challenges in matching trades.

The proposed change is predicted to result in a spike in operational costs and put additional strain on existing systems. Especially, smaller firms in the Asia-Pacific region, perceived as unprepared, might struggle with the necessary adjustments within the timeframe.

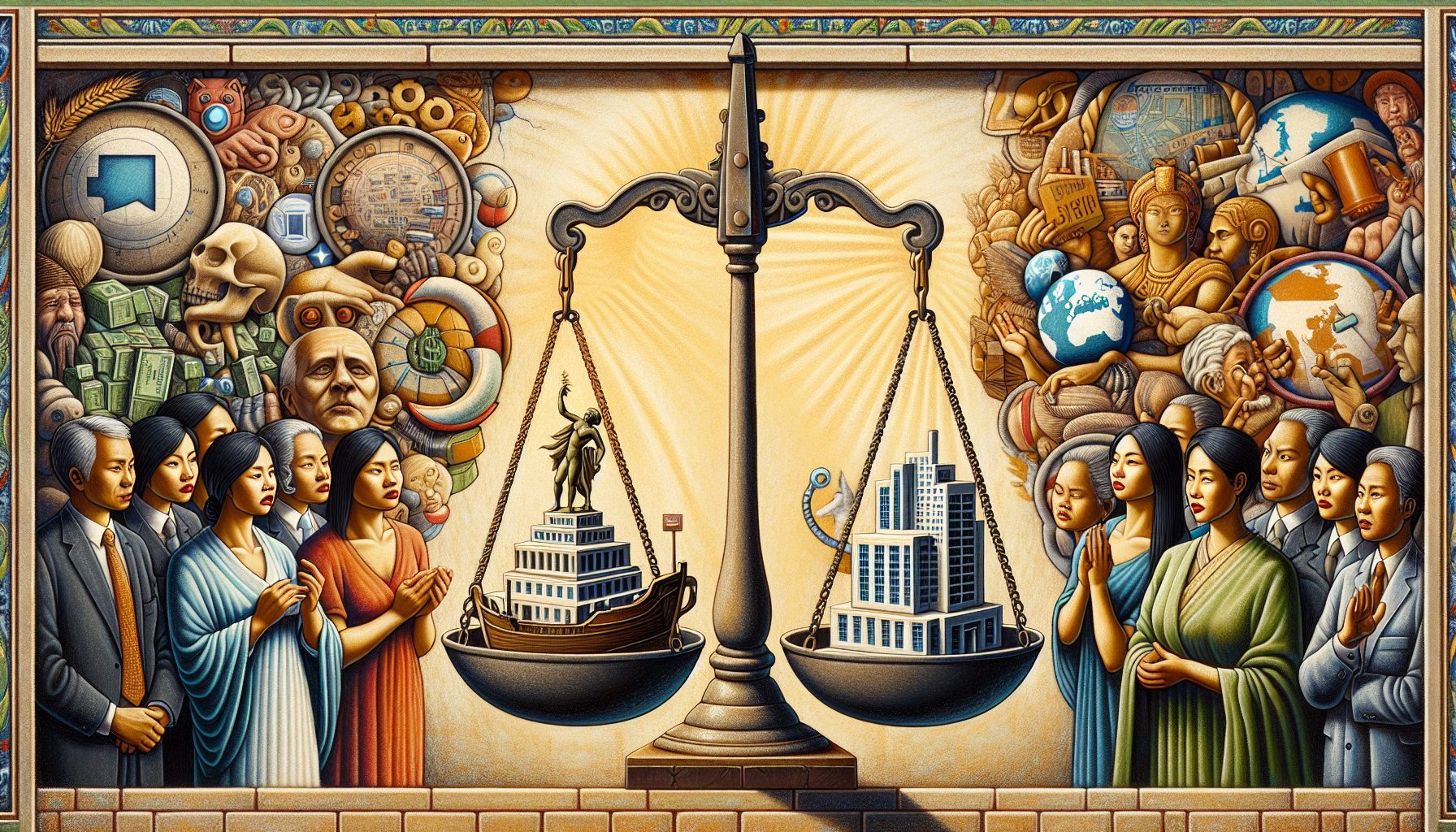

Moreover, complexities in cross-border trades could increase owing to varying settlement periods in different countries. Observers suggest that careful planning and coordination are vital for a smooth transition and to avoid market disruptions.

Companies investing in U.S. stocks might suffer a financial deficit as they will have less time to finalize trades. The timeline for personnel in Hong Kong to perform trade settlement operations could shrink to between 4 a.m. and 7 a.m., potentially leading to productivity challenges.

Managers in the Asia-Pacific region trading in U.S. equities, American depositary receipts, bonds, mutual funds, and exchange-traded funds with U.S. securities exposure will be most affected. These managers will have nearly 30 hours, a shortened operational window, from the start of a trade to its clearance and settlement, requiring strategic adjustments in their approach.

Further, there will be increased demands for efficiency in trade processing, settlement, and asset servicing. There will be an emphasis on technology solutions for real-time, cross-border information sharing and processing. Ensuring personnel understand these changes and can respond accordingly is also crucial.

Studies indicate potential difficulties managing trades and addressing related foreign exchange issues in the new system. For example, the New York Stock Market closes at 4 p.m. EST, with a deadline for trade allocations at 7 p.m., providing minimal buffer for unforeseen contingencies.

The prospect of funding deficits for U.S. trades has left asset managers uneasy. The transition to a shorter settlement cycle is believed to cause discrepancies with other markets, further stoking investment firm anxieties.

Asset managers may resort to temporary financing, a deferred settlement arrangement, or futures contracts to overcome settlement discrepancy periods. However, these measures may inflate investment costs. Asset managers need to accurately predict and balance financial requirements to avoid such extra expenses. Implementing the aforementioned strategies also necessitates thorough planning to minimize possible surprises or unintended consequences.